For the first time since before the COVID pandemic, non-promo prices are rising faster than shelf prices. Everyday prices are now 18.6% higher than in 2020, prior to the COVID pandemic. The steady decline of promotions has decelerated while everyday price increases accelerate.

Out of Stocks Slowly Disappearing

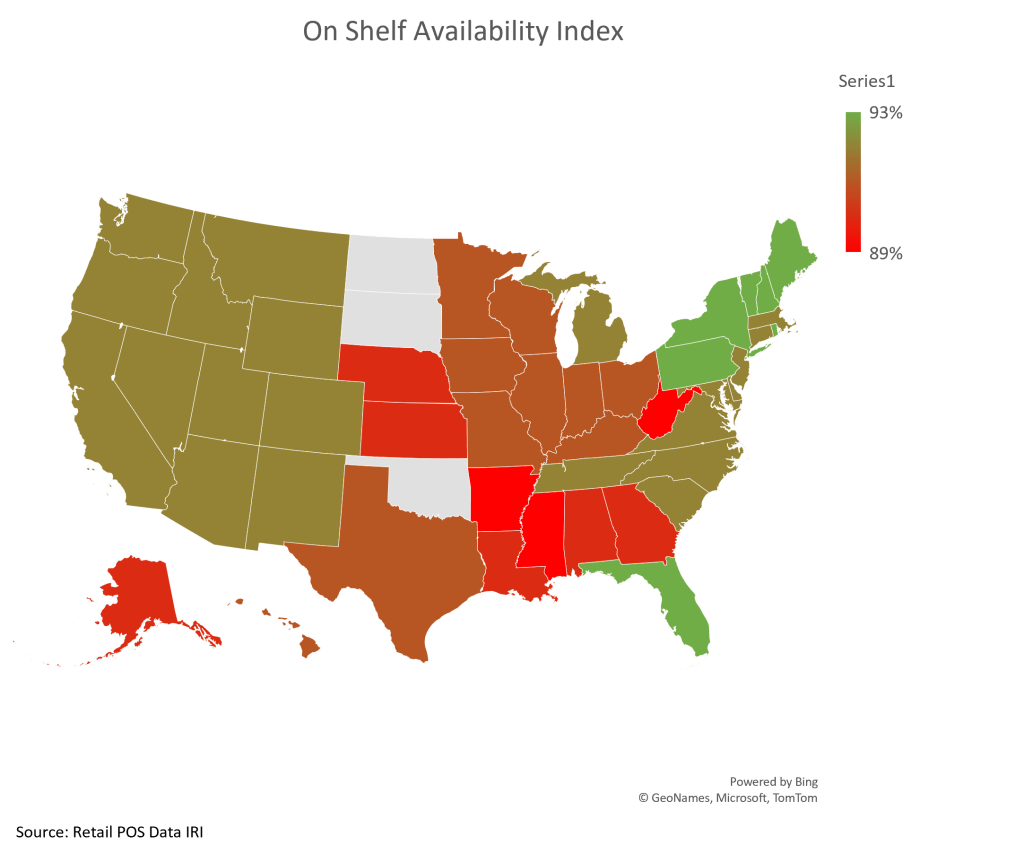

In March of 2020, during COVID pandemic buying, out of stocks skyrocketed over 20% vs. a historical average of 8%. According to the latest IRI research, for the first time out of stocks have returned to 8% in mid-July. Out of stocks are the lowest on the coasts and are much more prevalent in the South and Great Lakes. The highest out of stock levels are seen in Mississippi, Arkansas and West Virginia.

4th of July Promotions

Like Memorial Day, July 4th had fewer promotions vs. 2021. While there were 2.5% fewer promotions on the 4th of July, promoted depths of discount were more aggressive vs. 2021. July 4th was the first week in 2022 with deeper promotions than the prior year. Everyday prices however were nearly 2pts. higher on the 4th of July compared to Memorial Day earlier in the Summer. High-low retailers continue to see the largest price increases with prices up 10-12% vs. prior year while EDLP retailers are seeing only 6-8% price increases.

Following the 4th of July, Amazon aggressively promoted grocery items including 883 items during Prime Day. Promotions were most common on Coffee, Energy Drinks, Oatmeal, Tea, Cereal and Nuts during Prime Day.

June Price Inflation

Total FMCG prices are up over 10% year over year driven by Perishables and Grocery prices. Within Grocery the highest price increases are in the Frozen department. Perishables are still up mid-teens but year over year but Meat and Produce are slowing up just under 10%. Perishables prices are driven by Deli and Prepared. Price increases are broad based across the US with Texas and the Southwest continuing to see the largest price increases.

As out of stocks decline retailers can be more strategic vs. reactive about their price and promotion strategies. With fewer promotions, retailers now need to focus their promotion dollars on the items that drive their Price Image. On everyday, where prices are increasing, retailers need to focus on maintaining a competitive price on the items that matter. Engage3 helps many of the world’s leading retailers track and optimize their Price Image. We can help you identify the right promotions to run and the optimal everyday prices to maximize margin and revenue.